스크린샷:

최소

OS

아키텍처x86,x64,ARM,ARM64

권장

OS

아키텍처x86,x64,ARM,ARM64

설명

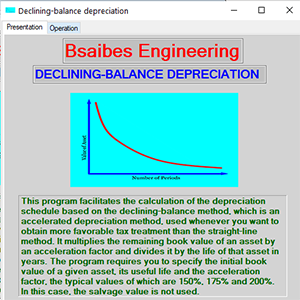

This program facilitates the calculation of the depreciation schedule based on the declining-balance method, which is an accelerated depreciation method, used whenever you want to obtain more favorable tax treatment than the straight-line method. It multiplies the remaining book value of an asset by an acceleration factor and divides it by the life of that asset in years. The program requires you to specify the initial book value of a given asset, its useful life and the acceleration factor, the typical values of which are 150%, 175% and 200%. In this case, the salvage value is not used.

피플 추천

리뷰

물품

약 DECLINING-BALANCE DEPRECIATION SCHEDULE

Advertisement

인기 다운로드

인기 앱

최고 평점 앱

최고 평점 게임