Captures d’écran:

Minimum

Système d'exploitation

Architecturex86,x64,ARM,ARM64

Nos recommandations

Système d'exploitation

Architecturex86,x64,ARM,ARM64

Description

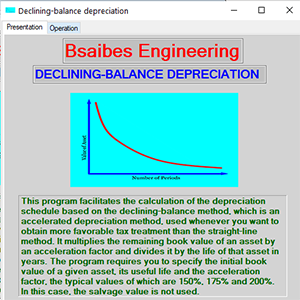

This program facilitates the calculation of the depreciation schedule based on the declining-balance method, which is an accelerated depreciation method, used whenever you want to obtain more favorable tax treatment than the straight-line method. It multiplies the remaining book value of an asset by an acceleration factor and divides it by the life of that asset in years. The program requires you to specify the initial book value of a given asset, its useful life and the acceleration factor, the typical values of which are 150%, 175% and 200%. In this case, the salvage value is not used.

Autres contenus plébiscités

Évaluations

Articles

À propos de DECLINING-BALANCE DEPRECIATION SCHEDULE

Advertisement

Top Télécharger

Applications tendance

Applications les mieux notées

Jeux les mieux notés